How measurement of KPIs can help to improve your business

Author: Kestutis Skrodenis

One of the key factors in sales is to be quick, at least compared to your competitors. The old joke says, “you don’t have to outrun the bear – you just have to outrun other campers”.

So when trying to outrun their competitors, businesses need to constantly improve the process and measure it. Let’s take a look at leasing software tools that can help you to evaluate operational KPIs in lease origination.

Operational KPIs are measures expressing the business performance in a short timeframe. Measures are of three types:

- quantity (e.g., number of new applications)

- quality (number of application/re-submit cycles)

- timing (e.g., application to contract)

In asset finance business, lease and loan products, the origination process typically has these five stages, at a high level:

- Quote

- Application

- Approval

- Contract Documentation

- Lease Activation

In this article we will describe operational measures by process stage.

Measures in the lease quotation stage

The first steps using your leasing software should be to establish a measurement, set goals and monitor the results to ascertain how administrative decisions, new tools, new financing programs, new sales channels and sales training are contributing towards the goal. Measure examples:

“Time-to-Quote” – number of minutes from quote record created until emailed/issued to the customer. This timing may be improved by using pre-sets of interest rates, residual values, pre-configured programs, pre-configured promotions, and customer credit score/rating automation.

“Number of Quotes” – simple number of quotations per day or per week. From a time perspective, this measure gives an indication of volume of work done by salespeople, or, in the case of customer self-service, its reach to potential customers.

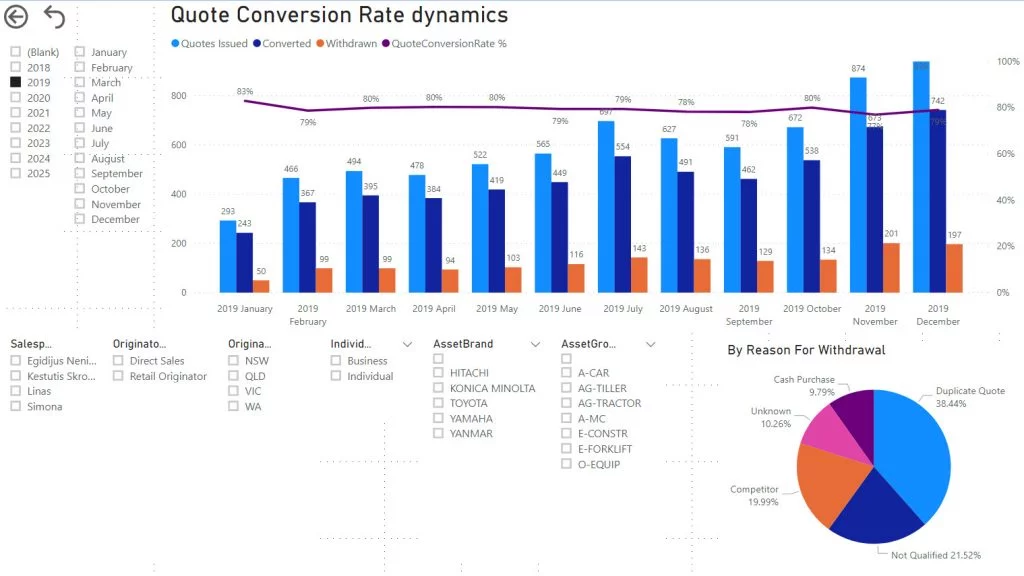

“Conversion Rate” – No. of Quotes to No. of approved applications ratio. Measure of sales efforts vs. sales results. Note here, it may be challenging to bring quotes and approvals to the same time period, as there is often a lag between “quote created” and “application approved” events. Technically, leasing software will help you to count “number of approved applications by date of quotation” and view the measure with delay of standard quote validity (e.g. 30 days).

“Withdrawals by Reason” – number of withdrawn/expired quotes by reason. May give insights for further improvement by analyzing lost deals.

Measures in Application stage

“Time-to-Submit” – timing between “application created” and “application submitted for approval” events. Indicates the amount of time required to provide applicant and guarantor details, and to compile required supporting documents (like proof of income, proof of address, proof of employment, etc.) With simpler application form and fewer (or no) documents required you get better KPIs, and you are more likely to secure the customer.

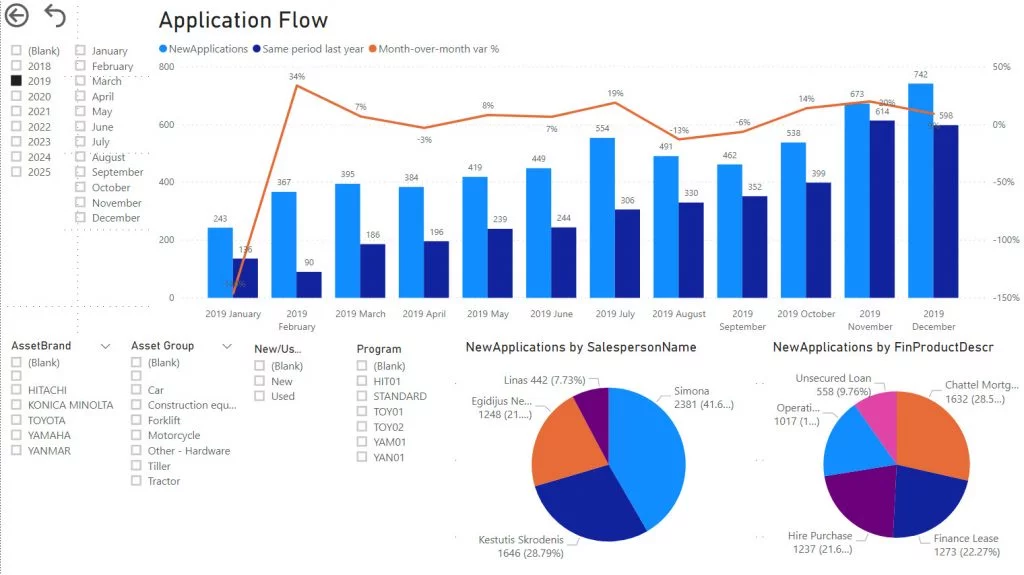

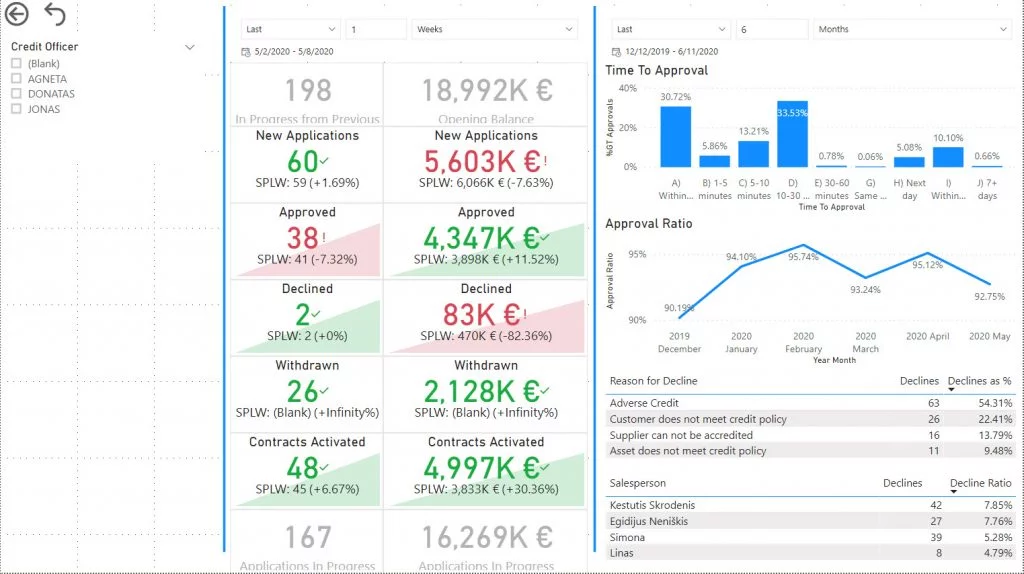

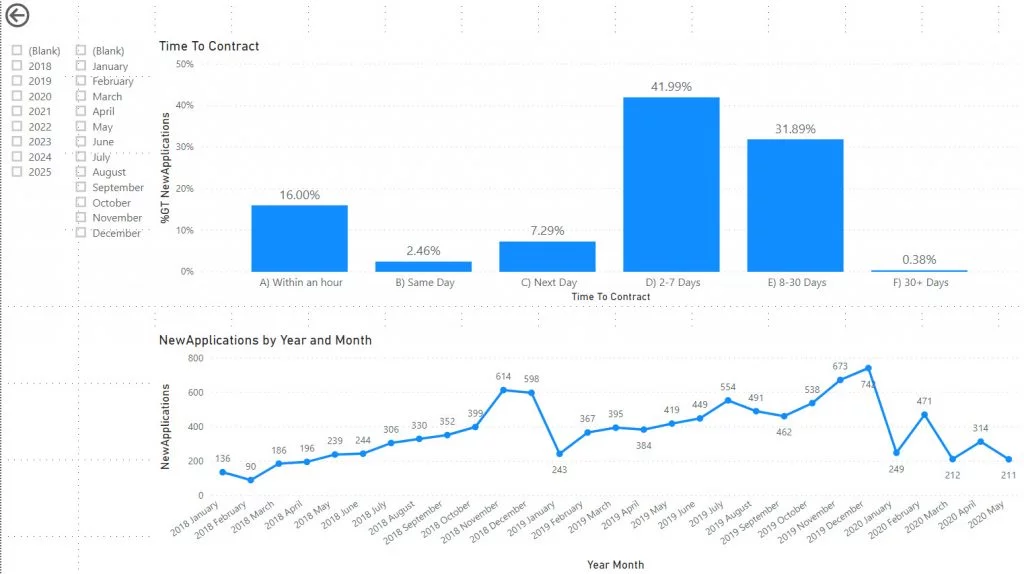

“Number of Applications”, “Number of New Applicants”, “IRR of New Applications” – trivial measures, similar to “number of quotes”, but need to be viewed in combination with “approval rate”, which indicates quality of submitted applications.

Measures in lease approval stage

“Rate of Approval” – the ratio of approved applications to total number of submitted applications within the period. If the approval process is a matter of days (not hours or minutes), there may be a need to technically shift the count of approvals and count “approvals by date when application submitted” (not by date of approval). This measure indicates the quality of lease applications you may want to analyze by introducer (by salesperson), to see where improvement is required.

“No. of Referred Back (by Reason)” – number of cases in which a credit officer had to return the application back to introducer because of missing supporting documents or incomplete application, or non-compliance with credit policy. The application may be referred back more than once, so there is a need to count number of events, not number of applications. Application update and re-submit would slow down the overall origination process, therefore it needs to be minimized—and for that, leasing software will help you to evaluate the reason of referral.

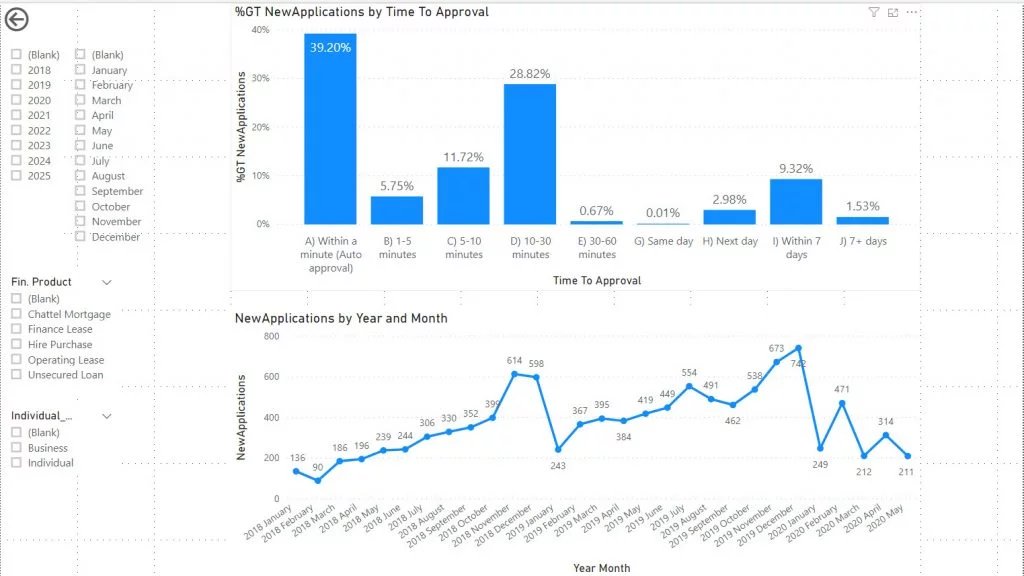

“Time to Approval” – timing between “Application submitted for approval” and “Approved”. This may be measured as physical time, or SLA time (for example, application submitted after office hours, if not auto-approved, would be handled by credit officer next morning by 9 am, which is 1 hour SLA time, assuming business hours start at 8 am). This performance metric may be highly improved by process automation in leasing software, for example a credit bureau interface, and automated decisioning system.

“Number of Approvals”, “Number of Approved Applications”, “IRR of Approved Applications” – trivial measures, should be easy to calculate in any leasing software.

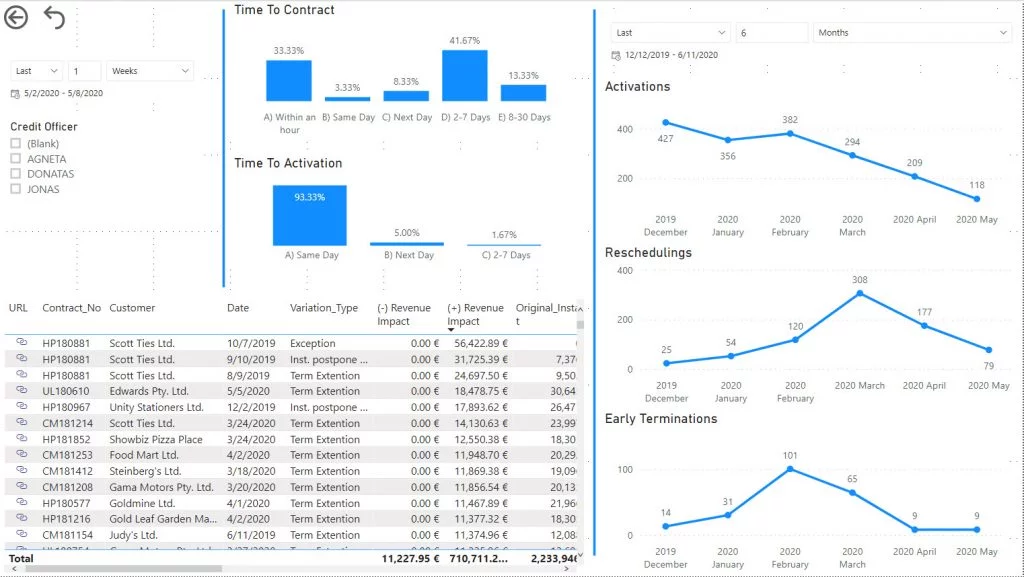

Measures in Contract Documentation and Lease/Loan Activation Stage

In this section measurement may differ, depending on the business process if the lease contract is signed after approval, or after asset delivery.

“Time to Contract” – timing between approval and lease contract issued to the customer. Automated document management and e-signature service may highly improve performance.

“Time to Activation” – timing from contract signed, all approval conditions met, and supporting documents provided (e.g., supplier invoice, delivery acknowledgement, asset insurance policy) until customer receives “welcome letter” with payment schedule and lease receivable created in accounting.

As every business process is unique, some aspects of lease origination may differ. Nevertheless, the main goal is the same: To make it quick and simple in order to drive more sales. On the other hand, the process must ensure legal compliance, and mitigate credit risk and fraud. So in order to be competitive, it is crucial to have effective leasing software that can not only improve the measurement of your business processes, but also keep them up to market standards and requirements.