Soft4Lessor – new software package for business which has small to medium volume of leases

Author Kestutis Skrodenis

Soft4 team introduces a new software package to the market – Soft4Lessor. Soft4Lessor is a software package for business which has small to medium volume of leases (from 1 to 1’000 leases) and requires a lease contract management system with comprehensive accounting in compliance with US GAAP ASC842, or IASB IFRS16, or equivalent local GAAP.

Soft4Lessor is ideal for:

- Car dealers, with installment sales;

- Real estate developers, with installment sales (see Note 1);

- Equipment manufacturers and distributors, who offer finance to their customers as an alternative payment method;

- Non-financial institutions, where leasing and asset financing is one of the business lines, but it is not the main business (see Note 2);

- Finance brokers, who aim to start a lending business;

- Startup finance companies, which require quick-to-start, but highly scalable solution (see Note 3).

Solution supports the following financial products: operating lease, rent, finance lease, capital lease, hire purchase/contract hire and chattel mortgage. IASB IFRS 16, US FASB ASC 842 and any local GAAP, which is equivalent to IFRS 16 or IAS 17 (e.g. Australian AASB 16) accounting standards are supported.

Note 1: for commercial property managers, we can also provide a combination of Soft4RealEstate and Soft4Lessor systems.

Note 2: for asset financing companies (main business) you could use more powerful end-to-end system Soft4Leasing.

Note 3: as the business grows, you can easily upgrade from Soft4Lessor (fast to start solution) to Soft4Leasing (full-scale, end-to-end asset financing system).

Functional Features

- Lease pricing calculation / Quotation

- Flexible lease payment structure:

- Front loaded payments

- Seasonal schedules / special payments

- Rent-free periods

- Indexation

- IRR calculation

- Master data of Lessees (can link to your core ERP or accounting system)

- Master data of Lease Units / Assets (can link to Fixed Assets in your core ERP system)

- Lease contract master data (enter in the system directly or using API)

- Lease data validation (e.g. residual value rules, interest rate collar)

- Document generation (Lease contract, based on multiple configurable templates)

- Document storage for signed contracts and supporting documents

- Allocation of down payment and upfront fees

- Balance with stock item, or supplier payable, or purchase order

- Generate payment schedule, incl. lease payments and related services

- Generate projection of lease receivable

- Projection of revenue recognition

- Projection of asset depreciation (where applicable)

- Handle guaranteed and unguaranteed residual values

- Handle upfront fees, running fees and termination fees

- Lease activation (produce G/L postings)

- Customer billing

- Customer payment allocation

- Overdue ageing

- Credit loss provision

- Lease variations/rescheduling

- Lease renewals

- Lease terminations, expirations

- Write-offs and shortfalls (non-performing contracts move to recovery process)

- Asset depreciation

- Track Asset insurance coverage

- Asset maintenance registration

- Asset returns and repossessions

- Monthly G/L journal for leases (Excel, data file or API to your core ERP system)

Reports

- Current Portfolio Analysis (outstanding lease receivable per dimensions)

- New Business per period (net investment over the period, per dimensions)

- New business trend

- Portfolio movement in period (opening + new deals + renewals- repayments – terminations, etc.)

- Maturity analysis report (future cash flows per maturity bands)

- Revenue report (per periods and dimensions)

- Exposure report, per customer

- Current Overdue ageing

- Overdue history and trend

- Credit loss provisions (opening, increases, decreases, closing)

- Asset book value report

API interfaces

- Upload Customer master data

- Download Customer master data and balances

- Upload asset master data

- Download asset master data, depreciation, book values

- Upload lease agreements (basic data for calculations)

- Download lease agreements with payment schedules and amortization projections

- Download lease invoices

- Download Lease receivables due

- Upload customer Collections

- Download G/L journal for the period

- Download G/L balances and net changes

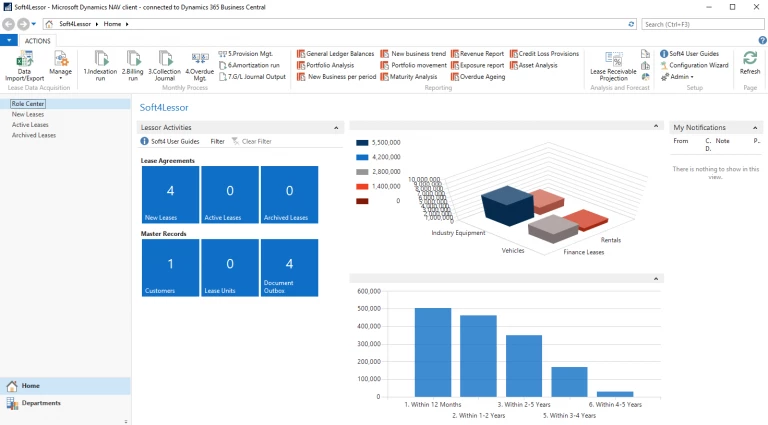

Look and feel of the user interface